Home > Insurance Blog > The most interesting states of home insurance

The most interesting states of home insurance

Posted by Sedgwick’s temporary housing division on

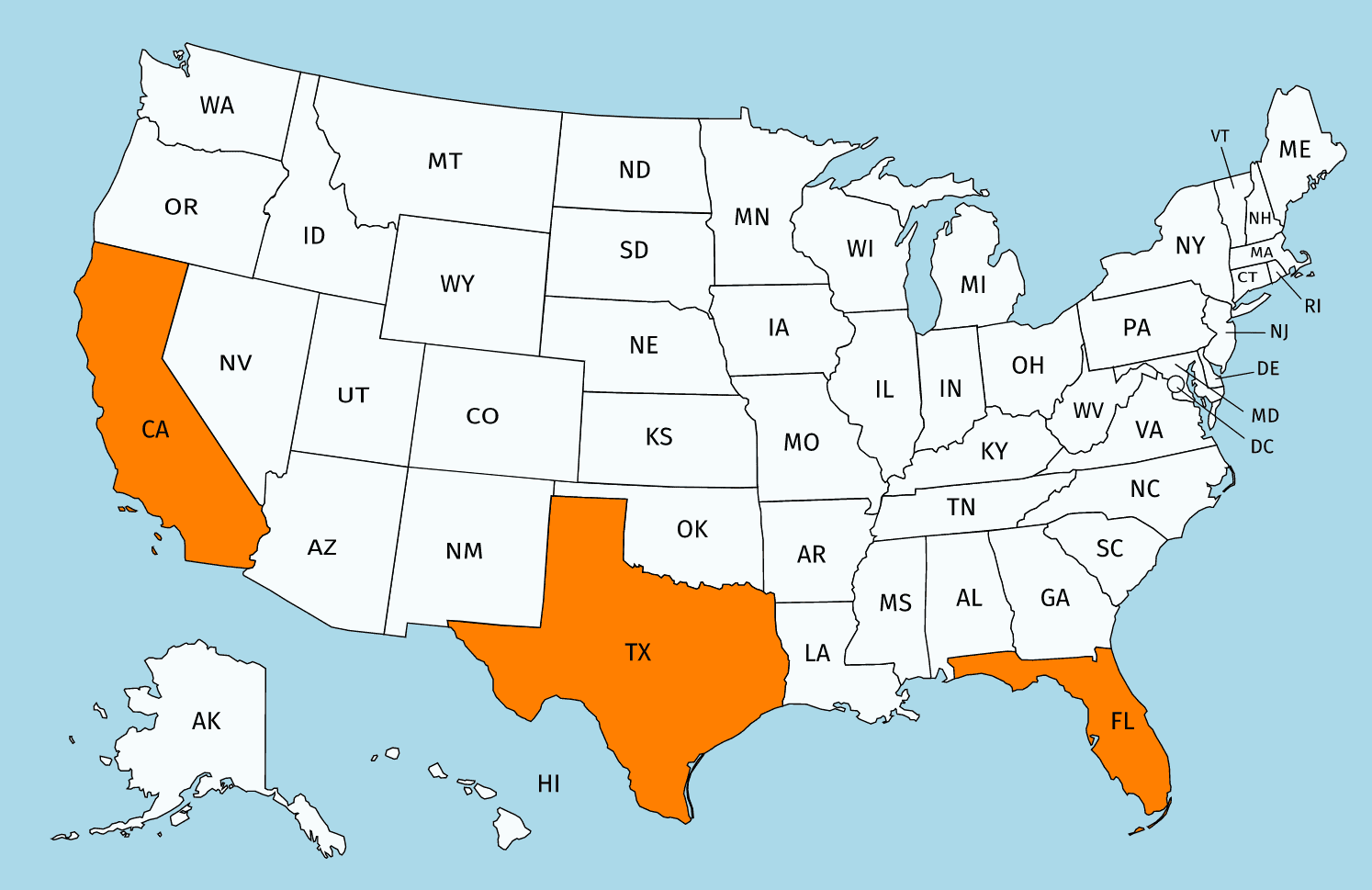

Anyone who relocates across state lines understands that costs for the same products often vary greatly. One example of this variance is homeowners insurance. The cost of a homeowners insurance policy covering a similar value property may be significantly different based on the state where the property resides. In addition to the cost, the coverage offered under a homeowners insurance policy is not the same across state lines. Certain specific exclusions apply in some states and not in others. Therefore, homeowners need to be aware of these differences. In particular, homeowners need to be aware of the states with the most unique property insurance standards. Three states, California, Texas, and Florida tend to have more policy differences than other states. By understanding these differences, homeowners can maximize the value of their home insurance policy.

Coverage differences per state

Each state has its own homeowner insurance coverage requirements, although some basic coverage terms are similar across these states. Below is a chart that shows the general coverage provided under a homeowners insurance policy. A typical homeowners insurance policy covers the main house, other structures, personal property, and liability protection. Based on the state, and its inherent risks, certain coverage restrictions or exclusions may apply. For example, earthquake coverage is not universal on all homeowners insurance policies in California. Due to the prevalence of earthquakes in California, coverage is difficult and expensive. Many homeowners end up self-insuring this coverage since it is so expensive to insure. Flood insurance is also not included in most homeowner insurance policies. Flood insurance is optional and depending on where a home is located, it may be expensive or difficult to insure. This is often the case in homes in low-lying areas, such as the Houston, Texas area or areas prone to significant rain events such as hurricanes along the gulf coast of Texas and Florida. Windstorm insurance differs in Texas and Florida. Florida requires that homeowner insurers offering coverage include windstorm protection as a part of their coverage offering unless the home is in a pre-determined high-risk area. Texas, on the other hand, does not require insurers to offer windstorm coverage nor does it require that homeowners maintain this coverage.

Adjuster differences by state

Each state has a different process in order for a property loss adjuster to earn a license. In fact, several states do not require a license to become an adjuster. California, Texas and Florida, however, each require a license and have their own requirements. In order to get an adjusters license in Texas and Florida, the adjuster must go through an application and testing process. Once licensed in either Texas or Florida, the adjuster is eligible for reciprocity in all states that require a license except California and New York. California requires adjusters to take an exam in order to earn a license in the state regardless of any already existing license. Based on data from the Bureau of Labor Statistics on average annual pay for claims adjusters by state, Texas adjusters earn more annually than any other state, at just under $78,000 after adjusting for cost of living. Adjusters in Florida and California earn $62,868 and $49,646 annually, which ranks 25th and 46th, respectively. The national average for adjuster annual earnings is approximately $62,000.

Housing differences by state

The housing market has a direct impact on the homeowner insurance market. As property values rise, the cost to replace homes also increases, which leads to higher insurance rates. Property values are much higher today than in the past several decades. In fact, according to a recent Business Insider article, after adjusting for inflation, the current median home price in the US is more than double its price in 1960 ($226K today compared to $100K in 1960). Further contributing to the insurance differences in California, Texas, and Florida are the home prices in these states. According to Zillow, the median home listing price in California is $549,900, or $324 per square foot, compared to the national median home price of $426,800. This makes California the third most expensive state for home values. Florida and Texas come in at 20th and 23rd most expensive respectively with median home prices of $299,000 and $283,499 respectively.

Catastrophic loss differences by state

Significant home insurance losses, also known as catastrophic losses, directly influence the property insurance market. An area with significant losses will have more stringent coverage requirements and higher premiums than areas with fewer losses. A catastrophic event typically is a loss that causes $25 million or more in insured property losses and affects a significant number of policyholder housing units and insurers. According to the Insurance Information Institute, based on 2018 catastrophic losses, California and Florida had the highest amount of damages, with Texas coming in at number #5. See the top seven listed in the chart below. These losses primarily represent wildfires, windstorms, thunderstorms, tornados, earthquakes, and hurricanes. California, most notably, has significant exposure to wildfires and earthquakes. Florida has a high risk of hurricane/windstorm losses as well as related thunderstorm, tornado, and hail risks. Texas often experiences the worst of both worlds. Texas has high exposure to both wildfires and windstorms, including thunderstorms, tornados and hail risks.

Top Seven States by Insured Catastrophe Losses, 2018 (1)

($ millions)

|

(1) Includes catastrophes causing insured property losses of at least $25 million and affecting a significant number of policyholders and insurers. Excludes losses covered by the federally administered National Flood Insurance Program.

Each state plays an important role in determining the cost of homeowners insurance and the coverage available to policyholders. If a significant loss occurs, then policyholder housing becomes an important issue. If a wildfire destroys a home in southern California, then temporary housing in Los Angeles might be necessary. If a hurricane affects a home in central Florida, then temporary housing in Orlando might be necessary. Insurers, policyholders, adjusters, and state insurance personnel must continue working together in an effort to ensure that homeowner insurance remains broad and affordable for all policyholders, even in states exposed to catastrophic loss events.

Filed Under: Homeownership, Insurance Claims, Rental Property Management, Temporary HousingNew Housing Request

Submit a new housing request and our team will notify you of housing options in your area!

Customer Reviews

MM

The staff members are compassionate, understanding, concerned

They are the most patient understanding people

Everyone I spoke with was able to give me direct and exact information.

ND

She handled everything for my family's accommodations and my dogs as well.

After catastrophic water and mold damage to my home, I needed to be relocated as soon as possible.

CC

I really cannot say enough good things

TS

Huge Kudos to Haleigh Shuler at Temporary Accommodations for her work

I highly recommend using them for any housing needs.

I highly recommend them!

Thanks so much Temporary Accommodations!

Temporary Accommodations is now Sedgwick. Read more here or Visit Sedgwick.OK