Home > Insurance Blog > The future of property claim handling

The future of property claim handling

Posted by Sedgwick’s temporary housing division on

The home insurance industry is rapidly changing. New efforts toward damage prevention are becoming more and more important to both adjusters and policyholders. Strengthening homes minimizes the potential for damage and is the only way to decrease the loss of property and life. In 2015 the federal government introduced the idea of the “Disaster Savings Account.” While this bill has stagnated, state governments, communities, and insurance carriers are still pushing for preparedness. Climate shifts bring new and unusual storm patterns to our shores. The rise of smart home technology and advancements in meteorology are both affecting the future of the property claims market. At Sedgwick’s temporary housing division, we strive to innovate the claim handling process year after year. Here are a few projections we’re taking into consideration when planning for performance excellence in 2018.

A passion for prevention

Most disaster aid funds are spent on response rather than mitigation. The trend toward preparedness is necessary, as this past year saw multiple billion+ dollar storms. While many states have increased tax incentives for storm resilient construction materials, more states are now requiring insurance providers to also offer policy discounts when these preventative steps are taken. Impact-resistant windows and waterproof airlock doors are two examples of preventative innovations being used in residential construction. States like Mississippi offer reimbursement grants for safe shelters.

Data-driven decisions

Sedgwick’s temporary housing division not only receives data from property damage claims, but also from the necessary home repairs that follow. Contractors often find ways to improve the safety of your home when making repairs, and in many cases, these improvements are requirements to bring a house up to code. Residential properties may need new electrical work to prevent the risk of house fires, or foundation replacement to strengthen the home’s stability. Structurally resilient home improvements are not always covered in loss of use policies, and in some cases, these fortifications do not increase the property’s value. It’s still important to address as many structural issues as possible during disaster reconstruction to be more prepared for the possibility of history repeating itself.

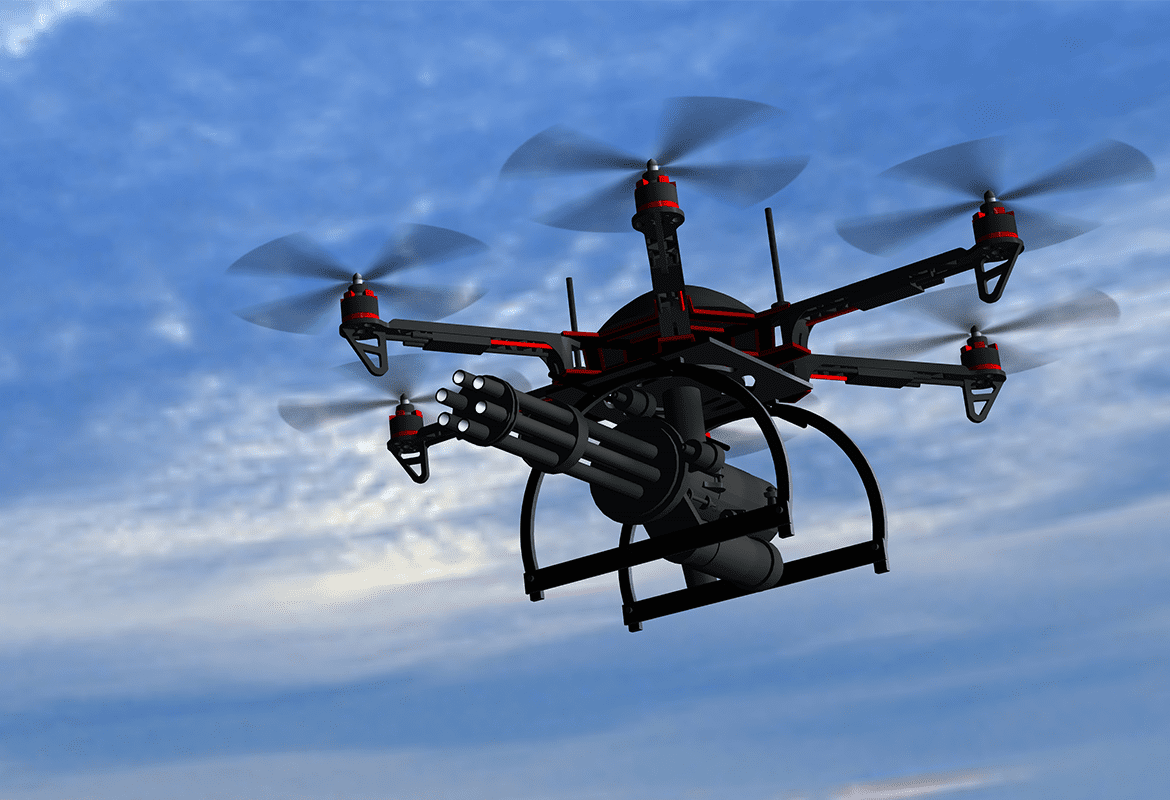

Damage assessment developments

Catastrophe sites have some new visitors. Until 2012 most home insurance claims were only inspected by field adjusters. Things really started changing after Hurricane Sandy when Smart Emergency Response Systems (SERS) began fitting dogs with special harnesses. These devices are able to collect meaningful data with cameras, microphones, and radiation or gas detecting sensors. Drones and robots have also entered the disaster scene, with telerobotics technology out of the University of Washington. The SERS team represents a strong effort to respond to disasters with the smartest tools available. As claims adjusters gather more detailed data from disaster damage, TA’s internal data will become more useful at predicting repair times and managing additional living expense budgets.

Claim handling innovation

Sedgwick’s temporary housing division makes claim handling hassle-free. Our automated ClaimTrak web portal allows you to submit, set spending limits, and insert special directions for a claim and then receive custom notifications when policyholders are moved into their hotel, request an extension, or move into a short-term rental property. ClaimTrak also allows you to review all your claim invoices and submit to your claims system for payment at the same time, all on one user-friendly profile. Sedgwick’s temporary housing division has provided the most caring insurance claim assistance for over twenty years, and we’re prepared to continue that legacy for the next twenty years and more.

New Housing Request

Submit a new housing request and our team will notify you of housing options in your area!

Customer Reviews

MM

The staff members are compassionate, understanding, concerned

They are the most patient understanding people

Everyone I spoke with was able to give me direct and exact information.

ND

She handled everything for my family's accommodations and my dogs as well.

After catastrophic water and mold damage to my home, I needed to be relocated as soon as possible.

CC

I really cannot say enough good things

TS

Huge Kudos to Haleigh Shuler at Temporary Accommodations for her work

I highly recommend using them for any housing needs.

I highly recommend them!

Thanks so much Temporary Accommodations!

Temporary Accommodations is now Sedgwick. Read more here or Visit Sedgwick.OK