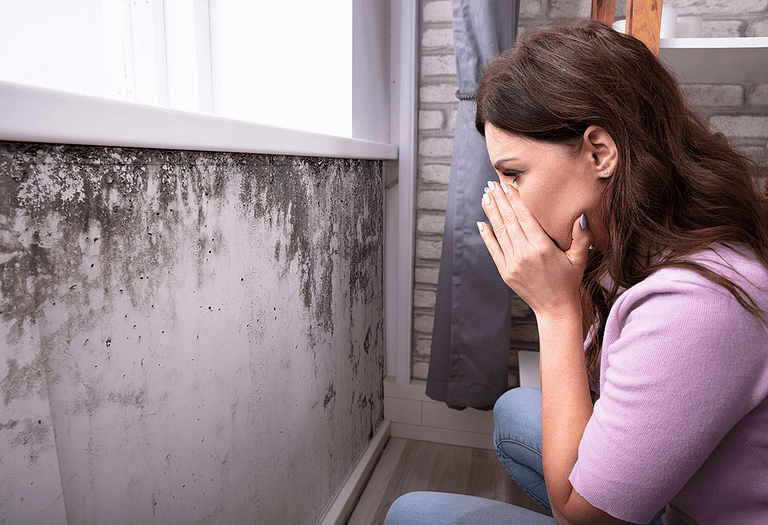

How to deal with mold in your home

Posted: March 29, 2021

Mold damage is one of the many headaches homeowners face. Mold damage may be covered by home insurance policies if it is the result of a sudden peril, and not the result of long-term neglect. Homeowners need to prevent mold in their homes because the most common types of mold damage are not covered by insurance. Preventing mold growth in your home benefits the overall...

An overview of home inventory apps

Posted: March 29, 2021

Keeping a home inventory has come a long way from the polaroid pictures of the 90s. These days, keeping an inventory of the items in your home is much easier and more reliable. While your pictures and lists of belongings could easily get damaged, destroyed, or lost, a home inventory app opens up a world of security and cloud-based memory that ensures your home’s contents...

Six tools insurance companies are using to mitigate fraud

Posted: November 11, 2019

Homeowner insurance fraud occurs when someone knowingly submits a false, inflated or misleading claim on his or her homeowner's policy. This type of fraud may appear in various forms. According to the Coalition Against Insurance Fraud, about 10 percent of property insurance losses are the result of fraud. Therefore, this type of insurance fraud directly influences the premiums that all property owners pay. In fact,...

Is your roof ready for storm season?

Posted: August 28, 2019

The intense heat of late summer is a good reminder of what lurks ahead… storm season. While hurricane season officially runs June 1 to November 30, the peak season is from mid-August to late October. Each year the number and severity of storms vary; however, storms spawning from daily thermal heating and tropical disturbances, if not hurricanes, are certain. Preparing for storms requires proactive thought...