Home > Insurance Blog > Mudslide, landslide, and avalanche insurance – shifting ground part 4

Mudslide, landslide, and avalanche insurance – shifting ground part 4

Posted by Sedgwick’s temporary housing division on

The only thing worse than sustaining home damage from a landslide, is realizing that a homeowners insurance policy will not cover the home damage. A standard homeowners insurance policy does not cover damage resulting from earth movement events such as mudslides, landslides, and avalanches. Given that property damage from this type of peril is often significant, homeowners need to understand the potential exposure for these events in order to determine if they need additional insurance. Insurers need to understand these risks in order to effectively market earth movement insurance in regions of the country most susceptible to this type of loss. In this article, we explore the risks associated with mudslides, landslides, and avalanches as well as the insurance solution for each of these exposures.

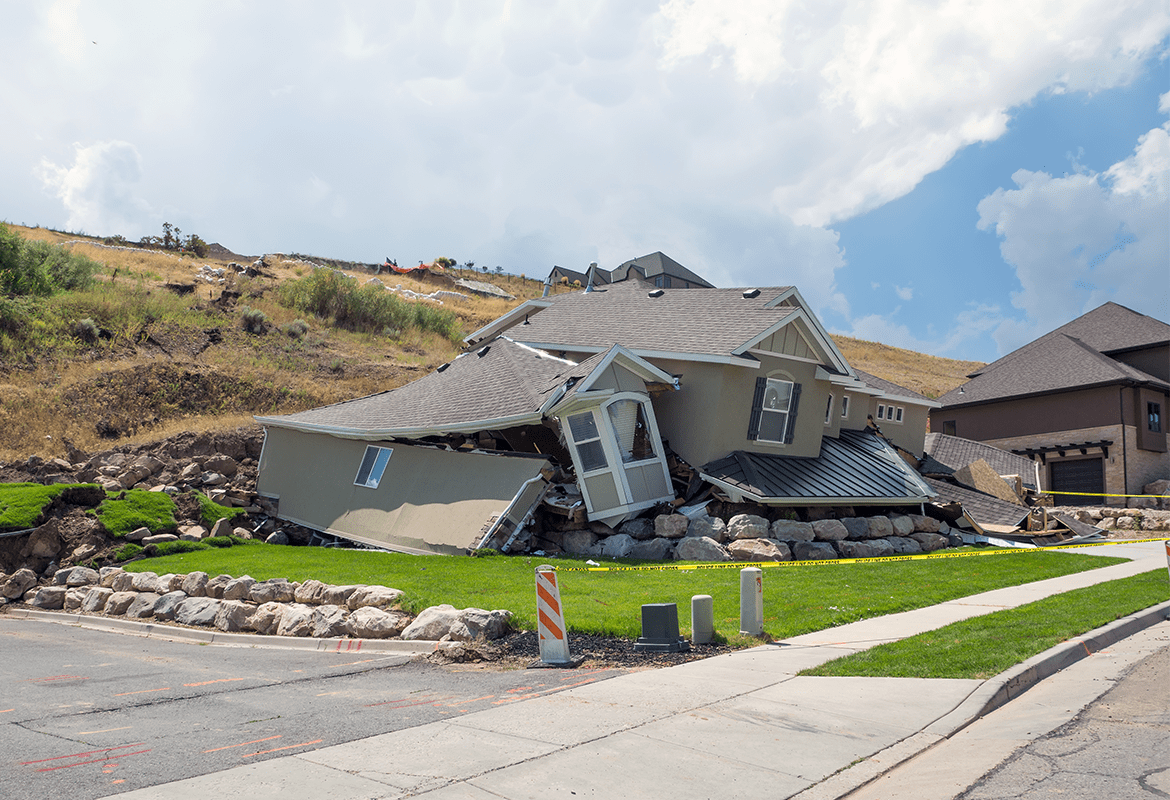

The below photo is from a May 2020 landslide in Waterford, New York.

Landslides

A landslide is the movement of a mass of rock, debris, or earth down a slope. The USGS describes a landslide as a “mass wasting” event which occurs when any down-slope movement of soil and rock occurs as a result of gravity. Landslides generally include five modes of slope movement, which are falls, topples, slides, spreads, and flows. Landslides, while rare, occur in all 50 States. In the contiguous United States, coastal and mountainous areas of California, Oregon, and Washington as well as the hilly regions of the Eastern United States represent the most significant risk of a landslide. Alaska and Hawaii also experience all types of landslides. USGS estimates that landslides in the United States cause approximately $3.5 billion in damage and cause between 25 and 50 fatalities on an annual basis. See the below map for a landslide risk analysis of the United States.

Mudslides vs. mudflow

A mudslide is a type of landslide that involves debris. Mudslides generally develop when a large amount of water gathers in the ground and leads to a surge of water-saturated rock, earth, and debris. Mudslides often begin after natural disasters. Mudflow, on the other hand, is the result of water picking up soil and turning into mud. The primary ingredient in mudflow is water. As a result, flood insurance usually covers at least some part of losses associated with a mudflow.

Avalanche

Avalanches occur when loose snow or snow slabs dislodge and move downhill. The snow moves slowly at first then accelerates reaching speeds of up to 80 miles per hour. As a result, this fast-moving mass leads to significant destruction in the area it travels. Sudden changes in weather, wind, or temperature often trigger avalanches.

Insurance implications

Homeowners insurance policies do not cover earth-moving events such as landslides or avalanches. Property owners with exposure to these risks can purchase a “Difference in Conditions” policy, which covers these named perils. The DIC policy provides “gap coverage” by proving coverage for the perils otherwise excluded under the standard homeowners or commercial property policy.

Weather events such as rainfall, snowmelt, changes in water levels, stream erosion, changes in groundwater, earthquakes, volcanic activity, disturbance by human activities, or any combination of these factors may contribute to landslides. As the impact of climate change increases the impact of weather events, the number and severity of landslides, mudslides and avalanches will likely increase as well. Insurers need to consider a future increased demand for this type of insurance coverage in the years ahead. By understanding the risks associated with these earth-moving events, homeowners can make wise decisions about their insurance coverage.

Filed Under: Homeownership, Weather Catastrophe | Tagged With: Home Damage, Landslide

New Housing Request

Submit a new housing request and our team will notify you of housing options in your area!

Customer Reviews

MM

The staff members are compassionate, understanding, concerned

They are the most patient understanding people

Everyone I spoke with was able to give me direct and exact information.

ND

She handled everything for my family's accommodations and my dogs as well.

After catastrophic water and mold damage to my home, I needed to be relocated as soon as possible.

CC

I really cannot say enough good things

TS

Huge Kudos to Haleigh Shuler at Temporary Accommodations for her work

I highly recommend using them for any housing needs.

I highly recommend them!

Thanks so much Temporary Accommodations!

Temporary Accommodations is now Sedgwick. Read more here or Visit Sedgwick.OK