Home > Insurance Blog > How to deal with mold in your home

How to deal with mold in your home

Posted by Sedgwick’s temporary housing division on

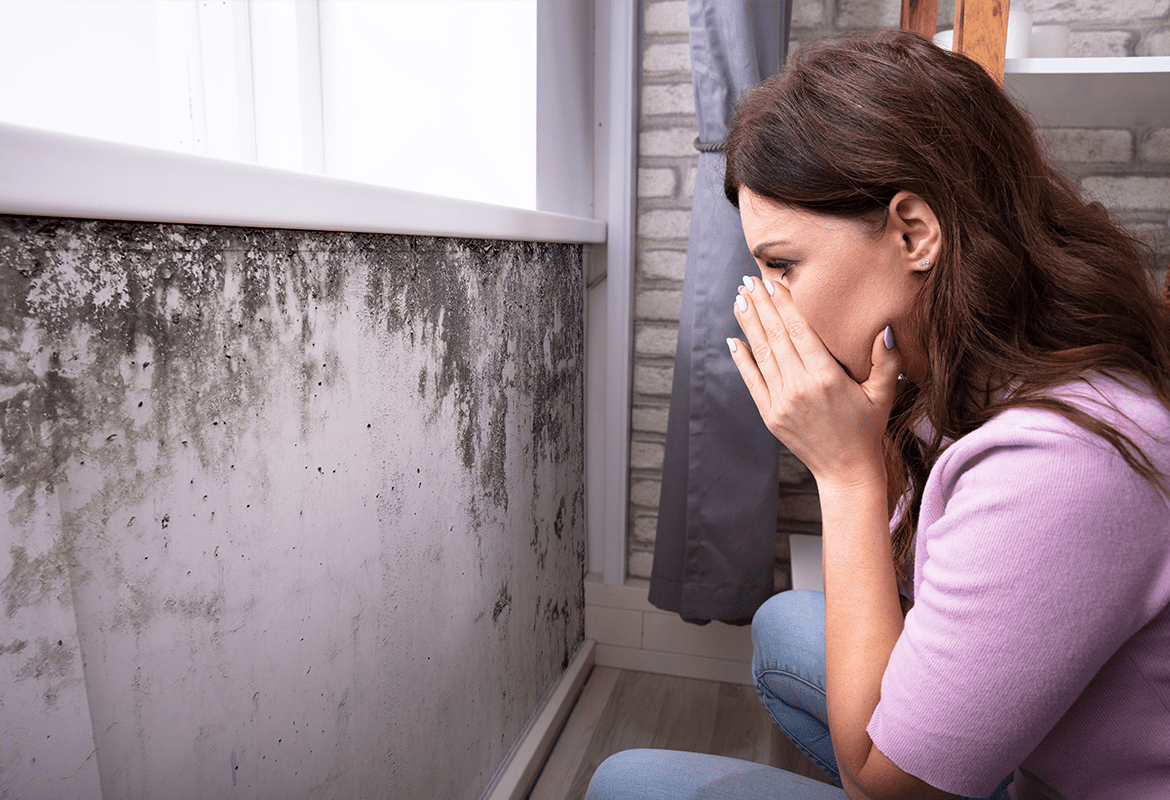

Mold damage is one of the many headaches homeowners face. Mold damage may be covered by home insurance policies if it is the result of a sudden peril, and not the result of long-term neglect. Homeowners need to prevent mold in their homes because the most common types of mold damage are not covered by insurance. Preventing mold growth in your home benefits the overall health of everyone who lives in the home, as well as the structure itself.

What are molds and why are they harmful to your home?

Molds are microorganisms, really tiny organisms you don’t notice unless you know where to look and also look hard. They belong to a family called Fungi; they could appear as furry growths, black stains, or specks of black, white, orange, and purple.

Molds are characterized as being very adaptive; these organisms can survive pretty much anywhere as long as there is moisture. Molds are not always bad; they are useful as decomposers in the environment, destroying organic materials like leaves. They become harmful when they gain access to your home because they not only affect your furniture, wood products, and fabric; they can also inflict a great deal of harm on your health.

Mildew is similar to mold, but mildew is a fungus that appears on the surface level of something that has gotten wet, while mold typically develops underneath the surface of something that has gotten wet. The visual appearance of mildew is usually white, yellow, or gray and might seem powdery. Mold on the other hand is usually black or green, or sometimes pink, and has a texture that is more slimy than powdery. Yuck.

Mold can make you prone to different respiratory diseases and expose you to eye, nose, and throat infections, and are even more dangerous in homes with infants or elderly people. These organisms are better off outdoors.

How to prevent mold damages in your homes.

Due to the adaptive nature of these organisms, it is much better to install preventive measures because once they are in; getting them out can be a huge struggle. Here are some basic but effective ways to prevent mold.

- Keep your home as dry as possible: mold can thrive as long there is moisture and it can grow within 24 to 48 hours. The first and most efficient way to prevent mold damages is to keep your environment dry all the time. Fix roof leaks and any plumbing issues immediately after you notice them. Always make sure the indoor humidity level is below 60%.

- When cooking in the kitchen, use your exhaust fans to remove moisture from the air and if you don’t have an exhaust fan installed, keep the windows opened. Also, make sure to keep pots covered to reduce moisture from getting into the air.

- Avoid keeping too many indoor plants in the home especially the bedrooms.

- Ventilate your damp rooms, keep the air dry, and use HEPA filter air purifiers to reduce mold spores in the air.

- Paint concrete floors and avoid using wall-to-wall carpeting; rugs are a much better option.

- Make sure you do not finish your basement walls with insulation and wallboard unless it’s absolutely dry.

- Install dehumidifiers in your basement. Dehumidifiers are electrical appliances that are useful in reducing or maintaining the humidity level in the air. They are different from humidifiers in that they extract water from the air while humidifiers add water to the air.

- Bathrooms are the most common place to find mold; this is why you need to take extra care to keep your bathroom dry. Install a ventilation fan in the bathroom and keep it on while taking showers. You should leave your bathroom fan on for a few minutes after you are done taking a shower. Also make use of shower curtains that are resistant to molds and avoid keeping shampoo bottles, gels, or sponge gourds in the shower.

- Wash your bath mats regularly. Bath mats often have the highest concentration of mold anywhere in the home! Try using stone or anti-microbial bamboo bath mats to avoid any chance of mold growth.

These are just some of the preventive measures you can take to avoid recurring mold damage in your home.

What do you do when you find mold?

- First of all, put on protective equipment, you don’t want to get sick while trying to get rid of the mold. Put on your rubber gloves, goggles, respirators, and old clothing you can toss after use.

- Now you can get to work, scrub moldy areas with stiff brushes, hot water, and soap or detergent.

NOTE: Do not make use of a detergent that has ammonia in it. Ammonia can be useful in cleaning molds from hard and impervious surfaces like tiles and glass but ineffective when it comes to porous materials like wood or drywall. What’s more, ammonia is highly toxic.

- Wipe clean and disinfect the area with a DIY (do it yourself) mixture of chlorine bleach and water.

- Allow the surfaces to air dry.

- Finally, you can get rid of materials that can’t be salvaged. Carpets and mattresses that are affected by mold should immediately be removed from the house. You can wash fabric items and continue to reuse them.

Getting rid of mold is a very rigorous chore. Preventing mold from growing is the safest option. Ensure you follow all the preventive measure guidelines listed above when dealing with mold in your home to avoid risks to your health and the risk of recurrent mold.

When should you call a professional for mold remediation?

Doing it yourself may be cheaper in the short-term IF you can completely eliminate the mold in your home. Mold is incredibly tricky to get rid of because mold spores are microscopic. Often it is best to call a professional if you find large patches of mold (bigger than your hand) or you have an auto-immune disease or compromised respiratory system. Some people have allergic reactions to mold, and mold has been linked to inducing asthma in children. If you are concerned about the health of your family it’s best to error on the side of caution and contact a professional mold remediation team.

Where do your insurance carriers come in?

Many homeowners are at a loss when it comes to mold and their home insurance policy. The important thing to remember about home insurance is that it is there to protect you from sudden accidents that you couldn’t foresee. Unfortunately, mold is rarely a sudden accident and usually progresses over time because a home’s humidity level is left unregulated. Controlling your home’s humidity level is an important part of homeownership.

When is the right time to contact your insurance carriers about mold damage?

Your insurance carrier would only cover your mold damage claims if the cause of the mold is a peril that is already covered in your home owner’s policy.

Example 1: Water damage caused by sudden and accidental incident you definitely could not have foreseen begins causing mold growth before you can initiate remediation.

Example 2: Accidents such as a kitchen fire occurred and water used by firefighters caused molds to grow. During these kinds of situations, your insurance carriers would cover the mold damage in addition to the fire remediation.

Mold damage would only lead to a property insurance claim if it was caused by an event similar to one of these examples and is considered a sudden accident. Mold damage caused as a result of your negligence would not be covered by insurance so take precautions to prevent mold and be careful when dealing with mold in your home to ensure it never returns.

Filed Under: Homeownership, Insurance Claims, Temporary Housing | Tagged With: dealing with mold, homeownership, mold remediation, property insuranceNew Housing Request

Submit a new housing request and our team will notify you of housing options in your area!

Customer Reviews

MM

The staff members are compassionate, understanding, concerned

They are the most patient understanding people

Everyone I spoke with was able to give me direct and exact information.

ND

She handled everything for my family's accommodations and my dogs as well.

After catastrophic water and mold damage to my home, I needed to be relocated as soon as possible.

CC

I really cannot say enough good things

TS

Huge Kudos to Haleigh Shuler at Temporary Accommodations for her work

I highly recommend using them for any housing needs.

I highly recommend them!

Thanks so much Temporary Accommodations!

Temporary Accommodations is now Sedgwick. Read more here or Visit Sedgwick.OK