Home > Insurance Blog > Earthquake and tsunami insurance – shifting ground part 1

Earthquake and tsunami insurance – shifting ground part 1

Posted by Sedgwick’s temporary housing division on

Homeowner insurance policies provide protection from perils such as storms, fires, hail, and wind. Many homeowners, however, do not consider less prominent risks when making a decision about insurance coverage. Earthquakes and tsunamis are two examples of risks that do not happen often but could lead to significant damage. Does a homeowner’s insurance policy cover earthquakes and tsunamis? In the below article, we answer this question and look closer at the risks posed by both tsunamis and earthquakes.

The United States may not seem like a hotbed for tsunamis and earthquakes; however, both of these natural disasters are capable of causing significant damage within US borders. Earthquakes occur on a regular basis, although significant earthquakes happen less often. It is common to think of tsunamis as events that occur only in other parts of the world near mountainous islands, such as parts of Southeast Asia. In reality, though, the underlying conditions that may lead to tsunamis do occur in the US. In fact, earthquakes are the usual cause of tsunamis. Since earthquakes occur in parts of the US near the coast, then the risk of a tsunami remains. The below chart shows areas in the US that have been historically impacted by tsunamis.

As noted in the above, Alaska and Hawaii are especially susceptible to tsunamis, mostly due to their coastal location and mountainous geography, which places them at an increased risk for earthquakes. Washington, Oregon, California, and the U.S. Caribbean islands are also at risk. The tsunami generated by the 1964 magnitude 9.2 earthquake in the Gulf of Alaska (Prince William Sound) caused significant damage and loss of life across the Pacific, including Alaska, Hawaii, California, Oregon, and Washington.

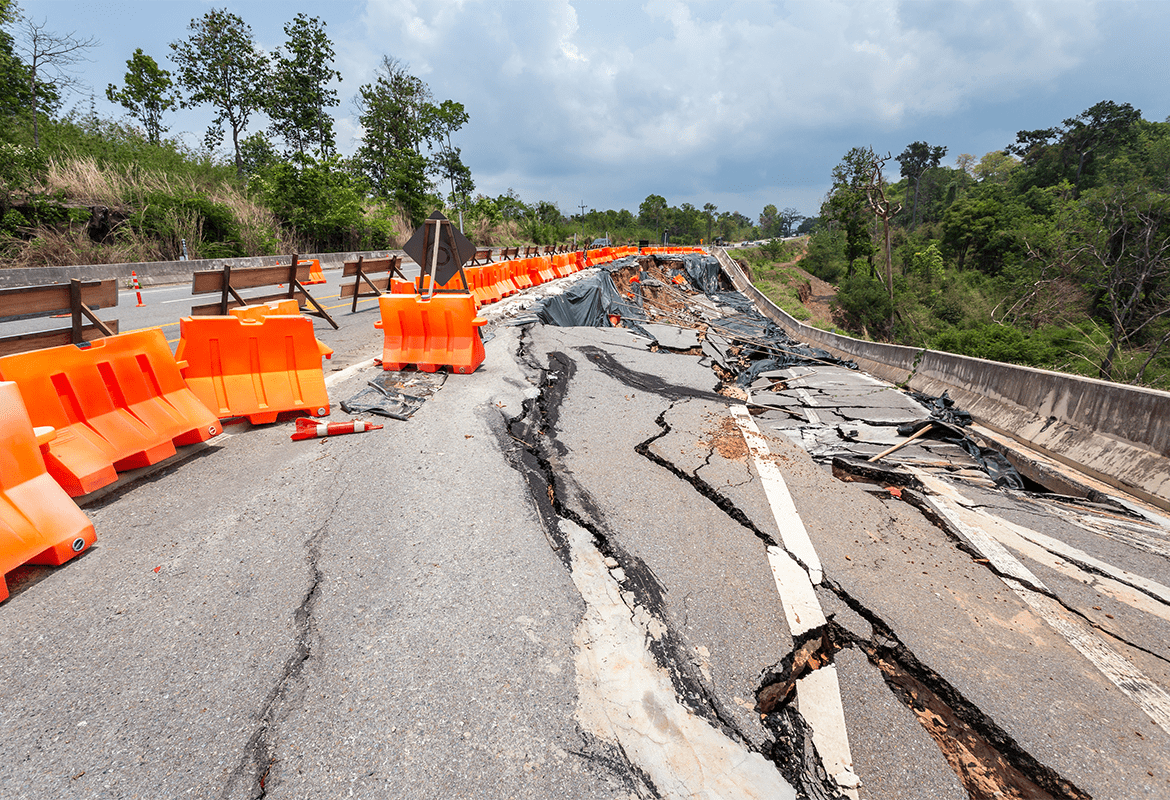

Earthquakes occur much more frequently than tsunamis, although most are small and do not result in damage. The below US diagram identifies areas susceptible to earthquakes. Since 1900, earthquakes have occurred in 39 U.S. states. The US mainland has not sustained a major earthquake since the 6.7 magnitude Northridge, California, event in January 1994. Five years earlier, the 1989 6.9 magnitude Loma Prieta quake struck the Oakland-San Francisco area during the World Series. Those two earthquakes represent two of the three costliest in US history, in terms of insured losses.

Typically, homeowners insurance policies do not respond to the damage caused by tsunamis. Tsunami damage usually involves rising water, which most homeowners’ policies do not cover as a part of the flood exclusion. In a similar manner, most homeowners insurance policies exclude coverage for earthquakes. In some cases though, if a tsunami or earthquake causes a fire or similarly covered peril, which then damages a home, then the homeowners’ insurance policy may respond to pay for damages.

Despite the significant risk of an earthquake in certain states, very few homeowners maintain earthquake insurance. In fact, in California, only 1 out of every 8 homeowners have earthquake insurance. This represents a significant opportunity for insurance carriers. Homeowners should understand the risk of a potential earthquake or tsunami and then consider the value of adding one or both types of policies to their coverage portfolio.

Filed Under: Homeownership, Weather Catastrophe | Tagged With: Earthquake, Home Insurance, Tsunami

New Housing Request

Submit a new housing request and our team will notify you of housing options in your area!

Customer Reviews

MM

The staff members are compassionate, understanding, concerned

They are the most patient understanding people

Everyone I spoke with was able to give me direct and exact information.

ND

She handled everything for my family's accommodations and my dogs as well.

After catastrophic water and mold damage to my home, I needed to be relocated as soon as possible.

CC

I really cannot say enough good things

TS

Huge Kudos to Haleigh Shuler at Temporary Accommodations for her work

I highly recommend using them for any housing needs.

I highly recommend them!

Thanks so much Temporary Accommodations!

Temporary Accommodations is now Sedgwick. Read more here or Visit Sedgwick.OK