Managing the stress associated with coronavirus

Posted: March 30, 2020

Raymond Shelton Ph.D., F.A.A.E.T.S. Director, Professional Development American Academy of Experts in Traumatic Stress We find ourselves in a time of unprecedented stress, anxiety, and uncertainty in the presence of the coronavirus crisis. The wellbeing of society; families, communities, businesses, organizations as well as our nation are all impacted. How do we survive and recover from such a massive assault on our population? As...

COVID – 19 response plan

Posted: March 13, 2020

Sedgwick’s temporary housing division continues to closely monitor developments related to the current outbreak of COVID-19 and we are dedicated to ensuring our customers have access to our services. As the situation evolves, we’re working closely with our employees, partners, and customers to support business operations and serve our customer’s needs. We are following the guidelines issued by the public health authorities, including the U.S....

Insurance industry jobs most threatened by automation

Posted: March 11, 2020

Technology adds many benefits to our daily lives including convenience, communication, and productivity. Technology makes both life and work easier, but it also poses some risks. Most notably, businesses utilize technology to its fullest capacity, which in turn leads to automation replacing human jobs. If artificial intelligence can improve productivity while decreasing operating costs, then most businesses welcome its use over that of a human....

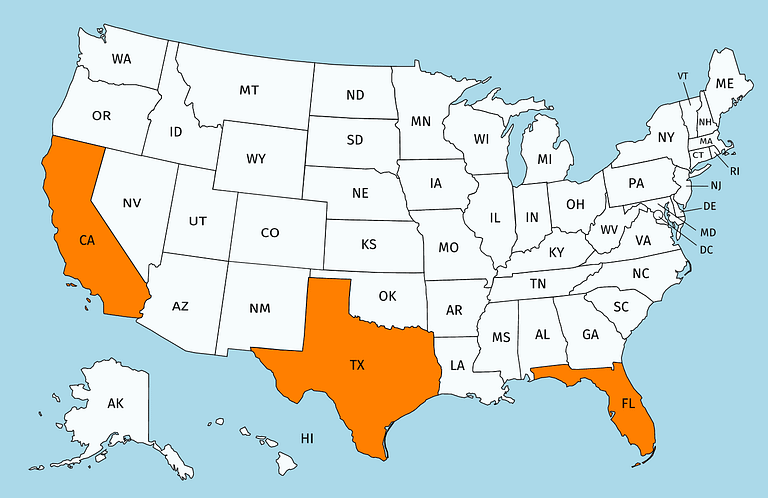

The most interesting states of home insurance

Posted: February 17, 2020

Anyone who relocates across state lines understands that costs for the same products often vary greatly. One example of this variance is homeowners insurance. The cost of a homeowners insurance policy covering a similar value property may be significantly different based on the state where the property resides. In addition to the cost, the coverage offered under a homeowners insurance policy is not the same...

Six tools insurance companies are using to mitigate fraud

Posted: November 11, 2019

Homeowner insurance fraud occurs when someone knowingly submits a false, inflated or misleading claim on his or her homeowner's policy. This type of fraud may appear in various forms. According to the Coalition Against Insurance Fraud, about 10 percent of property insurance losses are the result of fraud. Therefore, this type of insurance fraud directly influences the premiums that all property owners pay. In fact,...