What’s driving increases in home insurance premiums?

Posted: February 1, 2022

Many homeowners end up frustrated when the cost of their homeowners insurance rises. The general perception is that homeowners insurers are increasing premiums without just cause or in an effort to scam homeowners. In reality though, homeowners insurance premiums depend on several factors beyond the control of homeowners and insurers. In this article, we review these variables in order to give homeowners peace of mind...

Avoiding another Texas deep freeze

Posted: November 8, 2021

In February of this year, a statewide deep freeze occurred in Texas following a winter storm that rocked the property insurance industry. Significant damage resulted from a variety of issues following the storm. Most notably, the Texas power grid failed, leading to many uninhabitable homes in several heavily populated areas, including Houston and Dallas. Many people could not return to their homes for over two...

Property claim cost drivers

Posted: September 2, 2021

Anyone who has recently completed a home repair or renovation understands that costs continue to rise. As a result, the costs of property claims are also much higher for insurers. Upon closer examination, a few key factors influence the change in the cost of a property claim. These are important for insurers to understand in setting up structures to improve claim management. Cost of cleanup,...

How smart home technology is influencing home insurance

Posted: June 7, 2021

By now, most Americans have grown accustomed to smart devices. Whether it is a smartphone or a smartwatch, we interact many times a day with some sort of smart device. These gadgets have changed the way we live providing unprecedented convenience and productivity. Smart devices in the home are no different. Over the last few years, smart home devices and the internet of things (IoT)...

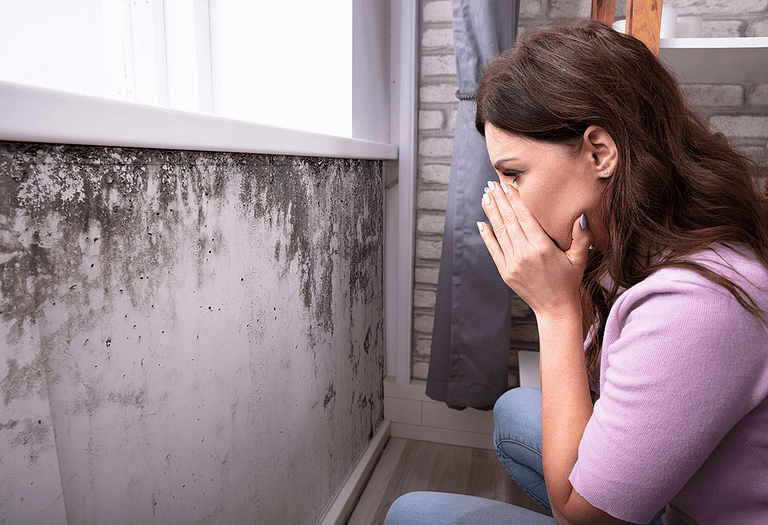

How to deal with mold in your home

Posted: March 29, 2021

Mold damage is one of the many headaches homeowners face. Mold damage may be covered by home insurance policies if it is the result of a sudden peril, and not the result of long-term neglect. Homeowners need to prevent mold in their homes because the most common types of mold damage are not covered by insurance. Preventing mold growth in your home benefits the overall...