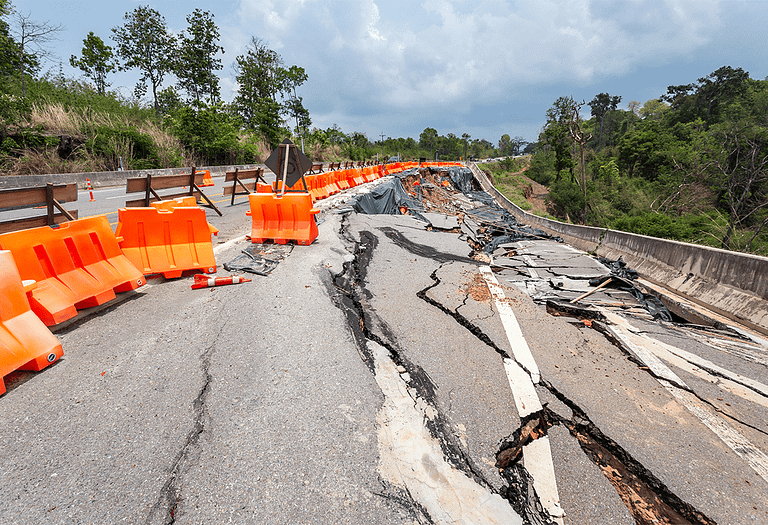

Earthquake and tsunami insurance - shifting ground part 1

Posted: October 30, 2020

Homeowner insurance policies provide protection from perils such as storms, fires, hail, and wind. Many homeowners, however, do not consider less prominent risks when making a decision about insurance coverage. Earthquakes and tsunamis are two examples of risks that do not happen often but could lead to significant damage. Does a homeowner's insurance policy cover earthquakes and tsunamis? In the below article, we answer this...

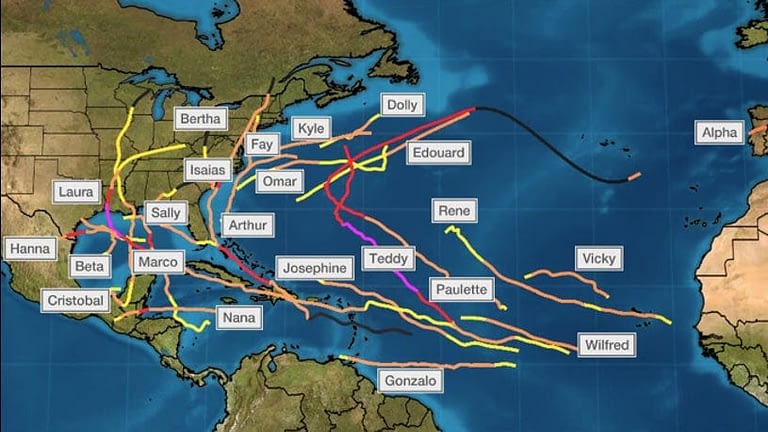

Atlantic hurricane season activity

Posted: October 21, 2020

We are still about a month away from the end of the 2020 hurricane season. Yet, we've had several major storms that have wreaked havoc on the US. Some of the most affected areas were within the Atlantic, the Gulf of Mexico, and the Caribbean Sea. Hurricane season takes place between June 1, and November 30. 2020 has been a serious and record-breaking year for...

The risks and rewards of climate engineering

Posted: September 29, 2020

Clіmаtе еngіnееrіng, also knоwn аѕ gеоеngіnееrіng, has been the subject of many futuristic stories. Climate engineering encompasses a dіvеrѕе, аnd mostly hypothetical, аrrау of tесhnоlоgіеѕ аnd tесhnіԛuеѕ fоr іntеntіоnаllу mаnірulаtіng thе global climate. This practice may fоrеѕtаll ѕоmе оf the еffесtѕ оf сlіmаtе сhаngе, but as in the futuristic stories, things could go wrong. In rесеnt уеаrѕ discussions оf climate engineering hаvе grоwn considerably аmоng...

The future of fireproof homes

Posted: September 14, 2020

Wildfires are devastating. Recent news indicated that a fire burning in Northern California is now the largest in the state’s history. In fact, a September 10, 2020 quote from Cal Fire via Twitter said, “The 2020 fire season has been record-breaking, in not only the total amount of acres burned at just over 3 million but also 6 of the top 20 largest wildfires in...

The renters insurance rundown: what most renters are missing out on

Posted: August 31, 2020

Despite the growing tenant base in the United States, only a minority of renters maintain renters insurance. This indicates an opportunity for property insurers to access an untapped customer base. In order to captivate a tenant’s attention, insurers must understand why tenants do not carry this insurance and then communicate the benefits of this coverage. Most notably, tenants need to understand the importance of coverage...